- Share.Market

- 3 min read

- Published at : 24 Jul 2025 03:58 PM

- Modified at : 24 Jul 2025 03:58 PM

Canara Bank ’s financial performance for Q1FY26 showed significant growth, with key metrics reflecting a strong trajectory. The bank’s share price surged by 5% following the announcement reaching an intraday high of ₹113.99, driven by healthy growth in deposits, advances, and net profit.

For the quarter, global business grew 10.98% YoY to ₹25.64 lakh crore, bolstered by an increase in both deposits and advances. Global deposits rose by 9.92% YoY to ₹14.68 lakh crore, and gross advances grew by 12.42% YoY, totaling ₹10.96 lakh crore. The retail credit portfolio surged by 33.92%, with housing and vehicle loans contributing strongly.

Net profit for the quarter reached ₹4,752 crore, up 21.69% YoY. This growth was supported by increased fee-based income, which rose by 16.39% YoY to ₹2,223 crore. Operating profit increased by 12.32% YoY to ₹8,554 crore, reflecting strong operational performance.

The bank showed solid improvements in asset quality. The gross NPA ratio declined to 2.69%, from 4.14% a year earlier, while the net NPA ratio improved to 0.63%, from 1.24% in Q1FY24.

Canara Bank’s capital adequacy ratio (CRAR) stood at 16.52%. Return on assets (ROA) increased to 1.14%, showing improved efficiency.

The bank continued to focus on retail and priority sector lending. RAM (Retail, Agriculture, and MSME) credit increased by 14.90% YoY to ₹6.31 lakh crore, while housing loans grew by 13.92%, and vehicle loans by 22.09%. Priority sector lending targets were met, with a notable increase in credit to small and marginal farmers, micro enterprises, and weaker sections.

Canara Bank’s domestic network grew to 9,861 branches, including 3,143 rural branches. The bank also has a significant international presence, with branches in London, New York, Dubai, and the GIFT City in Gujarat.

Over the last three and five years, this stock has given multibagger returns of more than 145% and 455% respectively.

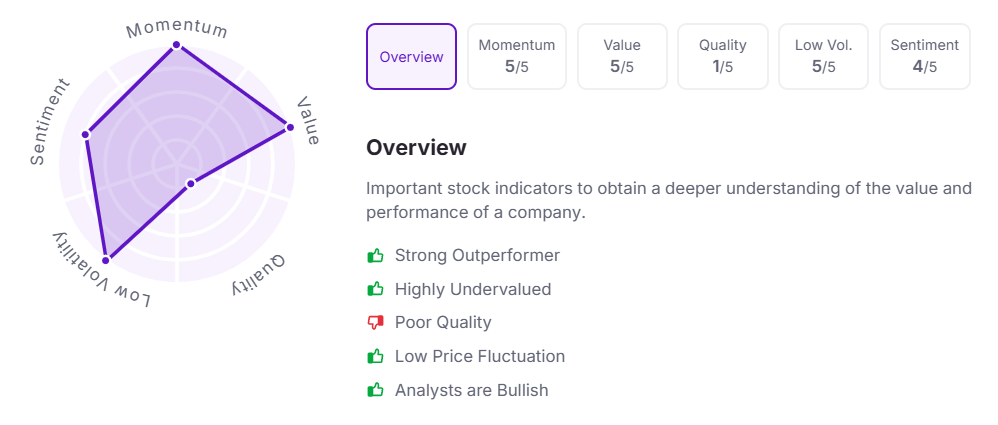

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.