- Share.Market

- 6 min read

- Published at : 08 May 2025 05:31 PM

- Modified at : 08 May 2025 05:31 PM

Anand Rathi Wealth, Bajaj Finance, Coforge, Laurus Labs, and Bank of Maharashtra are set to trade ex-dividend on Friday, May 09, 2025. Investors who wish to be eligible for the upcoming dividends, must have bought the shares before the ex-date and hold them at least till the record date.

Anand Rathi Wealth, a wealth management and financial servies firm, has announced a final dividend of ₹7 per equity share. The record date for the same is Friday, May 09, 2025. It has a dividend yield of 0.50% on a TTM basis.

The company had previously announced an interim dividend of ₹7 per share and a final dividend of ₹9 per share on October 18, 2024, and June 03, 2024, respectively.

Anand Rathi Wealth Ltd. is a leading wealth management firm focused on high-net-worth individuals, with over ₹77,000 crore in AUM across 11,700+ families globally. In FY25, the firm posted a 33.2% rise in net profit to ₹300.8 crore and a 29.7% growth in revenue to ₹939.1 crore, backed by rising AUM, strong client retention, and steady trail income.

This stock has given multibagger returns of more than 400% in the last three years.

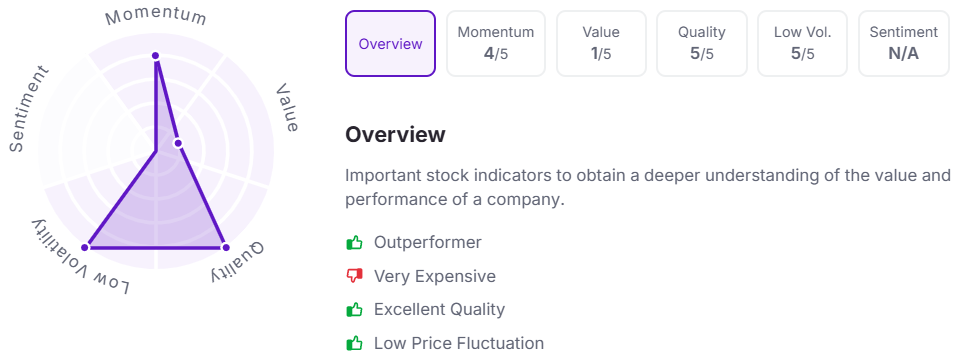

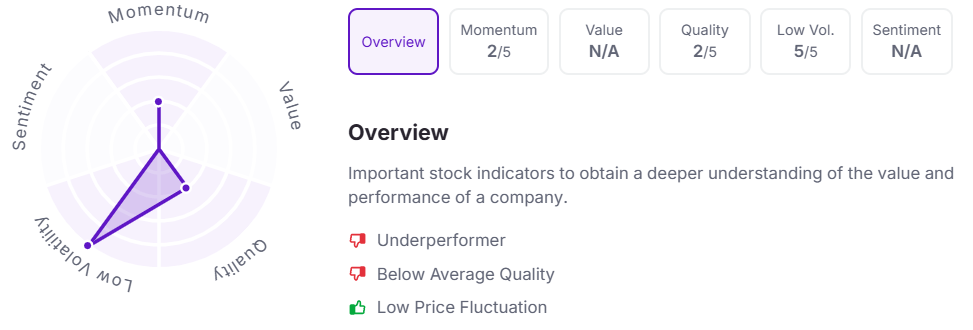

Let’s take a look at its Factor Analysis scores:

Bajaj Finance, an NBFC, has announced a special dividend of ₹12 per equity share. The record date for the same is Friday, May 09, 2025. The company has a dividend yield of 0.40% on a TTM basis. It had previously announced a final dividend of ₹36 per share on June 21, 2024.

Bajaj Finance is one of India’s leading financial services companies, offering loans, deposits, payments, and investment products to over 80 million customers. In FY25, the company added ₹86,046 crore to AUM, booked 43.4 million new loans, and added 18.2 million customers. While growth in volume and operating metrics was strong, elevated credit costs impacted profitability.

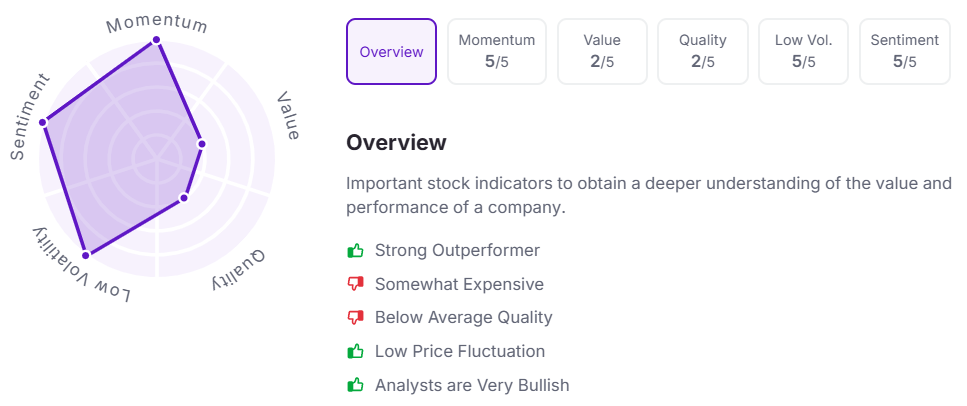

Let’s take a look at its Factor Analysis scores:

Coforge, a global digital services and solutions provider, has announced the fourth interim dividend of ₹19 per equity share. The record date for the same is Monday, May 12, 2025.

It has a dividend yield of 1.00% on a TTM basis. The company had previously announced a final dividend of ₹36 per share on June 21, 2024.

Coforge is a global digital services and solutions provider, leveraging domain expertise and emerging technologies across 30 delivery centers in 23 countries. It delivered an exceptional FY25 with 32% YoY revenue growth in constant currency and a 31.7% rise in EBITDA. Q4 revenue surged 47.1% YoY, aided by five large deal wins and a record $2.1 billion in order intake.

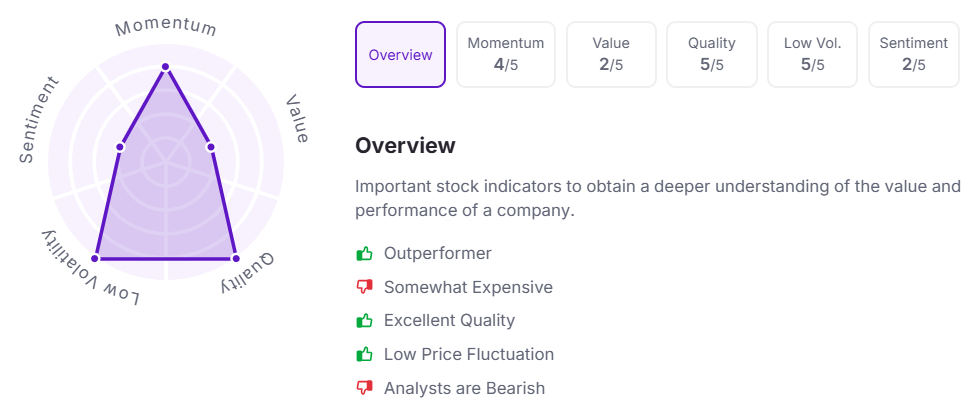

Let’s take a look at its Factor Analysis scores:

Laurus Labs, a research-driven pharmaceutical manufacturing company, has announced its second interim dividend of ₹0.80 per equity share. The record date for the same is Friday, May 09, 2025.

It has a dividend yield of 0.10% on a TTM basis. The company had previously announced interim dividends of ₹0.40 per share on November 06,2024 and May 08,2024.

Laurus Labs is a research-led pharmaceutical company specializing in APIs, intermediates, and contract manufacturing for global pharma firms. Founded in 2005, it has built strong leadership in anti-retroviral, oncology, and cardiovascular APIs, backed by robust backward integration and regulatory compliance.

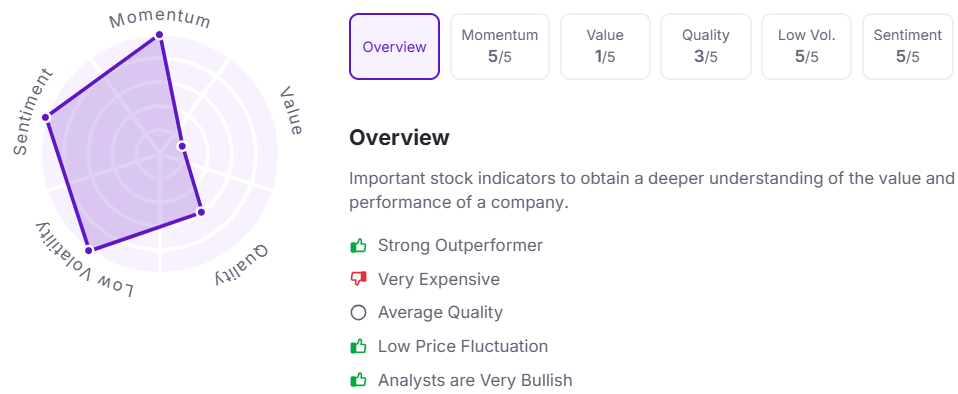

Let’s take a look at its Factor Analysis scores:

Bank of Maharashtra has announced a dividend of ₹1.50 per equity share. The record date for the same is Friday, May 09, 2025.

It has a high dividend yield of 2.70% on a TTM basis. The company had previously announced a dividend of ₹1.40 per share on May 10, 2024.

Bank of Maharashtra delivered a strong performance in FY25 with 36% profit growth and robust improvement in asset quality. Retail, MSME, and agri lending remained key growth drivers, with retail loans up 25.4% YoY. Capital adequacy stood strong at 20.53%, and CASA ratio improved to 53.3%.

This stock has given multibagger returns of more than 195% in the last three years.

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.