- Share.Market

- 4 min read

- Published at : 07 May 2025 04:04 PM

- Modified at : 16 Jul 2025 07:20 PM

The shares of Gravita India and Oracle Financial Services Software are set to trade ex-dividend on Thursday, May 08, 2025. Investors who wish to be eligible for the upcoming dividends, must have bought the shares before the ex-date and hold them at least till the record date.

Gravita India, a material recycling company, has announced an interim dividend for FY 2025‐26 of ₹6.35 per equity share. It has a dividend yield of 0.30% on a TTM basis. The company had previously announced an interim dividend of ₹5.20 per share on May 14, 2024.

Gravita India is a global leader in recycling and manufacturing, specialising in lead metal, aluminium alloys, and plastic granules. With state-of-the-art facilities in India and overseas, Gravita provides turnkey solutions for battery recycling and non-ferrous metals across 38+ countries. The company is recognised for its focus on sustainability, technical expertise, and integrated global supply chain.

FY25 was a record year for Gravita, with revenue, EBITDA, and PAT reaching all-time highs. Revenue rose 22%, EBITDA by 22%, and PAT by 31%, supported by strong volume growth and rising share of value-added products. The company maintained a robust pre-tax ROIC of 27%, with value-added products contributing 46% and non-lead segments over 30%.

Over the last three years, this stock has given multibagger returns of more than 500%.

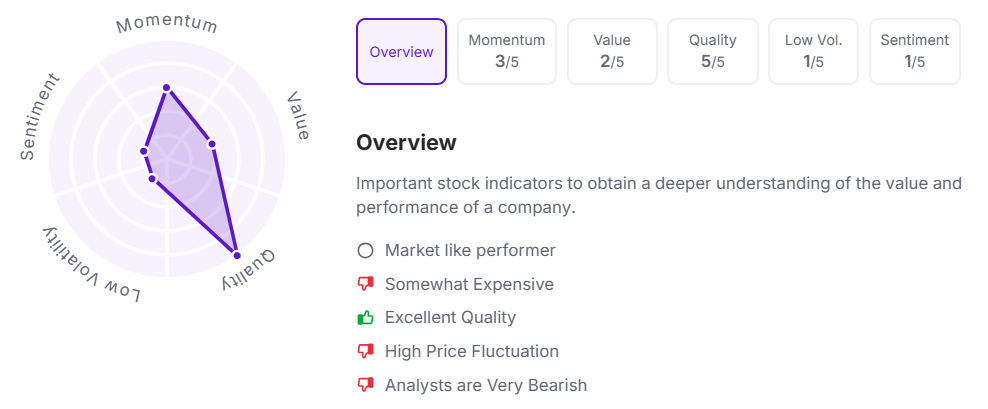

Let’s take a look at its Factor Analysis scores:

Oracle Financial Services Software, providing technology solutions and services to the financial services industry, has announced an interim dividend of ₹265 per equity share. The company previously announced an interim dividend of ₹240 on May 07, 2024.

Oracle Corporation is a global leader in enterprise software, cloud computing, and database solutions. Known for its autonomous Oracle Cloud infrastructure and integrated SaaS offerings, Oracle serves a wide range of industries across the world. Its key products include Oracle Cloud Infrastructure (OCI), Fusion Cloud ERP, and NetSuite, with a strong focus on AI, multicloud capabilities, and data security.

In Q3 FY25 (Dec – Feb), Oracle reported total revenue of $14.1 billion, up 6% YoY, driven by a 23% jump in cloud revenue to $6.2 billion. Cloud infrastructure (IaaS) revenue surged 49%, while SaaS revenue rose 9%. Net income grew 22% YoY to $2.9 billion, and GAAP EPS rose 20% to $1.02. The company ended the quarter with a record $130 billion in remaining performance obligations and announced a 25% hike in its quarterly dividend.

Over the last three years, this stock has given multibagger returns of more than 140%.

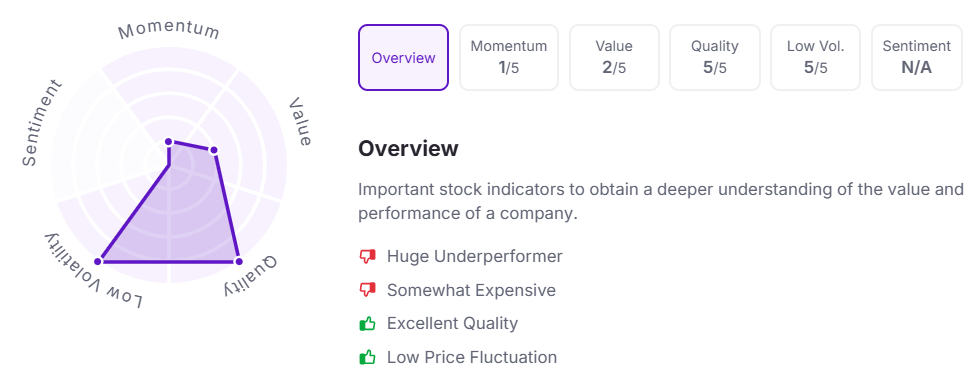

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.